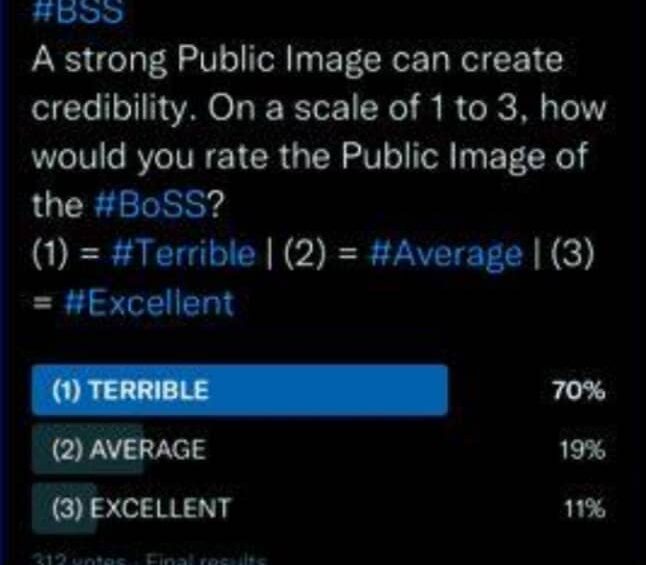

Opinion polls that the Bank of South Sudan conducted on Facebook from 1st to 7th September 2022. | (Photo: BSS.)

Public opinion polls conducted by the Bank of South Sudan to determine its public image has seen 70% rating the Bank as terrible.

The Bank says the opinion polls conducted on social media platforms from 1st to 7th September was part of its Strategic Plan 2023-2027.

It is reportedly to determine the benchmark where the Bank is in terms of public image at the second phase of the strategic plan.

However, the result posted on the official website of the Central Bank showed 11% of the public voting it excellent, 19 percent voted average and 70% voted terrible.

Despite the public disapproval, the Bank’s fight against inflation, at a time of global economic crisis, has been commended by international financial institutions

A delegation from the International Monetary Fund said in March this year that they were satisfied with spending of its US$225 million grants to the Government of South Sudan.

The IMF Mission Chief for South Sudan, Niko Hobdari, said they were contented with the achievements of the Bank of South Sudan to stabilize the market.

“We are encouraged by the economic reforms in South Sudan since the IMF engaged the Bank of South Sudan closely about one and half years earlier,” he said.

South Sudan is said to be at the peak of its worst inflation since independence, with the local currency ranked among the most deflated in the Africa.

As the country recovers from nearly a decade of conflict, global economic crisis and the impact of the COVID-19 pandemic, the Central Bank has adopted a policy of daily auction of hard currency to bring down inflation.

In July alone, Central Bank auctioned nearly 50 million US dollars to forex bureaus and commercial banks, as a measure to stabilize the skyrocketing exchange rate.

But economists have criticized the policy, saying it only benefits foreign commercial banks and Forex bureaus.

In 2018, the Central Bank launched the first strategic plan for a period of four years.

The strategic plan document set out the visions, core values and adopted four strategic themes and objectives along with the measures, targets and initiatives.

Business Insider Africa ranked the South Sudanese pound as the third worst performing currency after Sudan’s pound and Zimbabwe’s dollar in the latest ranking of African currencies against the US dollar.

The report was based on research by Steve Hanke, a professor at Johns Hopkins University, who investigated the value of African Currencies during the 1st quarter of the year.

Every week, Hanke, a Professor of Applied Economics and Director of the Troubled Currencies Project in the United States, publishes Hanke’s currency watchlist – a group of currencies that have depreciated by at least 20% against the dollar since January 2020.

In his latest list, he found out that the Zimbabwean dollar has depreciated against the US Dollar by 97.33% since January 2020, whereby he suggested that “Zimbabwe dump the Zim dollar and adopt the USD immediately.

Support Eye Radio, the first independent radio broadcaster of news, information & entertainment in South Sudan.

Make a monthly or a one off contribution.

Copyright 2024. All rights reserved. Eye Radio is a product of Eye Media Limited.