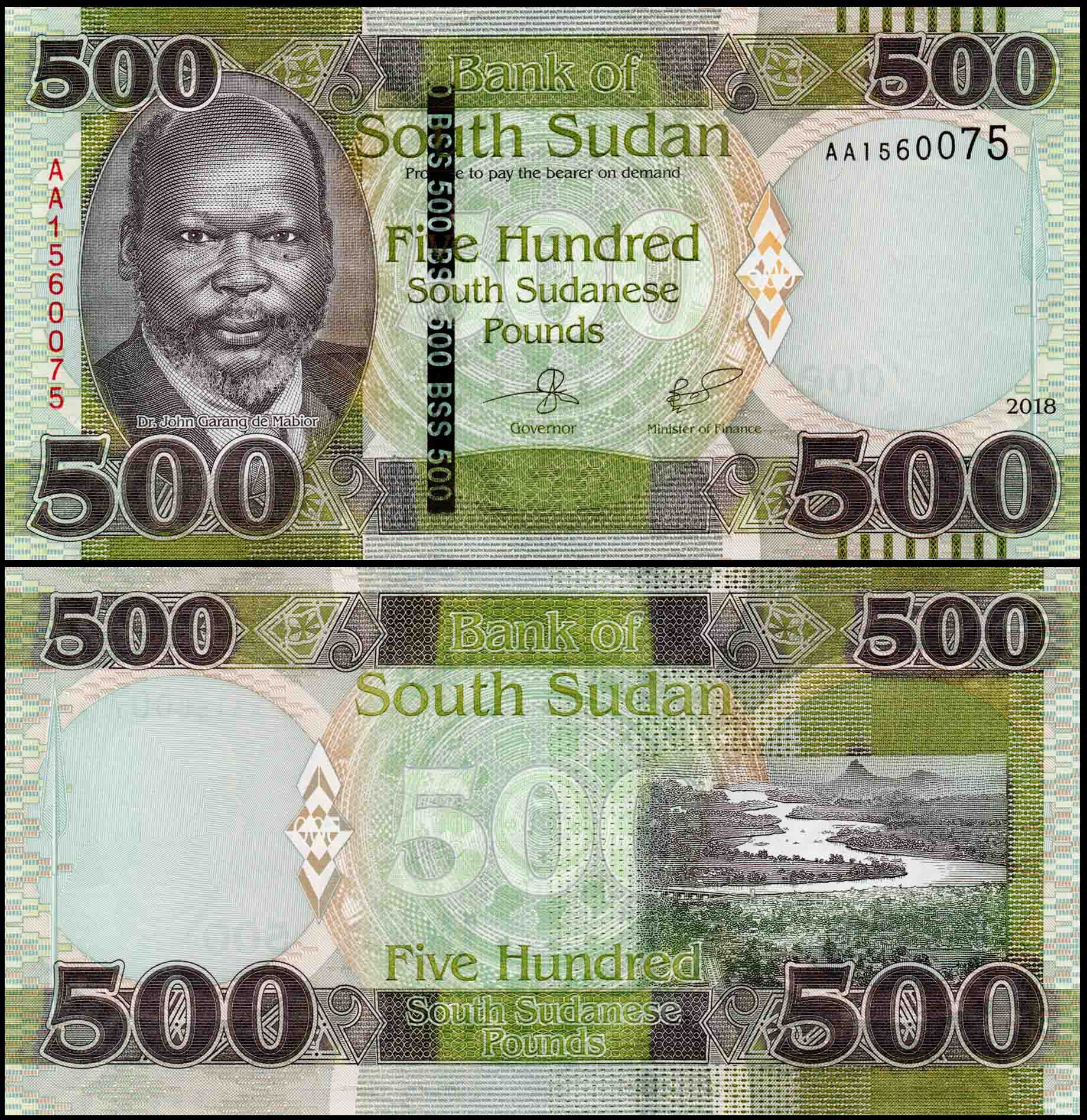

The South Sudanese pound is the third worst performing currency after Sudan’s and Zimbabwe’s dollar in the latest ranking of African currencies against the US dollar.

In a report published by Business Insider Africa, the Zimbabwean dollar has rated the 1st worst-performing currency in Africa followed by the Sudanese pound with South Sudan’s being 3rd.

The report was based on research by a professor at Johns Hopkins University that investigated the value of African Currencies during the 1st quarter of the year.

Every week, Steve Hanke, a Professor of Applied Economics and Director of the Troubled Currencies Project in the United States, publishes Hanke’s currency watchlist – a group of currencies that have depreciated by at least 20% against the dollar since January 2020.

In his latest list, he found out that the Zimbabwean dollar has depreciated against the US Dollar by 97.33% since Jan. 2020, whereby he suggested that “Zimbabwe dump the Zim dollar and adopt the USD immediately.

The Sudanese pound which comes second has depreciated against the USD by 84.95% since Jan 2020.

He suggested that Sudan’s pound & its economy install a currency board to address the challenge.

Meanwhile, South Sudanese pounds have depreciated against the USD by 50.79% since Jan 2020-something Hanke said, the country is experiencing an economic death spiral that never ends.

According to the ranking; Nigeria, Ghana Malawi, and Sierra Leon currencies came 4th, 5th, and 6th, respectively, experiencing depreciating rates at 42.57%, 39.54%, and 31.23% correspondingly.

In summary, Hanke state that the depreciation in “exchange rates in ten African countries will have a substantial influence on companies’ operations and profitability.

He added that the exchange rate volatility will affect not just multinationals and large corporations, but also affects small and medium-sized enterprises, including those who only operate in their home country.

Hanke advised that, while understanding and managing exchange rate risk is a subject of obvious importance to business owners, investors should also be familiar with it because of the huge impact it can have on their holdings. –