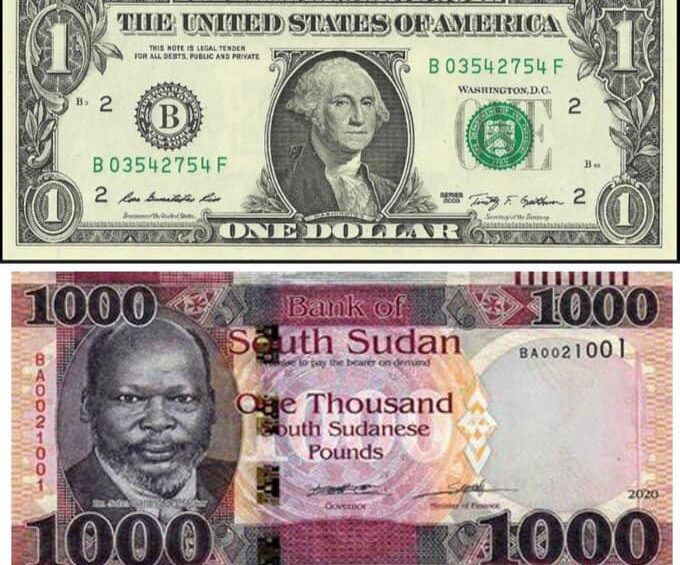

As of May 22, 2023, one U.S. dollar trades at 1,000 South Sudanese pound in the Forex market. | Photo: Courtesy.

As the South Sudanese pound depreciates to a historic low against the United States dollar, the country’s Central Bank said it is concerned about the situation, and for the first time, attributes it to South Sudan’s dependence on imports.

In January 2023, one dollar was trading at SSP.600 in the Forex Market. Five months later, the pound is trading at almost double the January exchange rate.

As of Sunday, May 22, 2023, the exchange rate for one U.S. dollar is at a staggering 1,000 pounds in the Forex market and at around 950 pounds in the Central Bank.

In neighboring Uganda, the exchange rate is relatively stable with one U.S. dollar exchanged for 3,720 UGX in January this year and at 3,728 UGX in May.

– High prices –

Some Juba City residents on Thursday complained about sharp rise in commodity prices in the markets.

Ajok Mathiang, a consumer and broker at the Jebel market said the inflation has made everything expensive including the cheapest commodities and services.

“I run around just like this, and everything as you see is expensive. Food is so expensive when I buy things in sacks, it’s not even enough,” he told Eye Radio.

“I have my brothers children staying with me at home plus my own children and my wife. I make about 15,000 SSP a week, and after that week I have to buy food items in sacks again.”

Mathiang said even the price of a cup of tea has jumped from SSP.100 to SSP.400 in five months.

He told Eye Radio his 15,000 wages a week are not enough to cater for his family’s needs when the price of 50 kilograms of flour is now ranging from SSP.35,000 to SSP.45,000.

Some charcoal sellers and boda-boda riders have also decried the hike in commodity prices – saying the worsening exchange rate has left them unable to afford basic needs.

At the northern border regions, Ruweng Administrative Area and Northern Bahr el Ghazal State have complained about a worsening economic situation resulting from the conflict in Sudan.

– Import dependency –

The Central Bank on Friday said the sharp depreciation of the local currency against the U.S. dollar is partly, due to dependence on imports from the region.

“These developments are exacerbated, partly by widening balance of payment gap due to import dependence syndrome, multiple external factors such as the hike in interest rate by the Federal Reserve Bank, and global inflationary pressures,” a BOSS statement reads.

A balance of payment is the difference between all money flowing into the country in a particular period of time and the outflow of money to the rest of the world.

What the Cental Bank means by balance of payment gap is, more revenue is heading out of South Sudan than the country receives.

South Sudan is landlocked and currently imports about 50 per cent of its needs, including 40 per cent of its cereals from neighboring countries, particularly Kenya, Uganda and Ethiopia, according to African Development Bank.

The Central Bank further said the ferocious fighting in Sudan and geopolitical conflict in eastern Europe have created uncertainties and pushed up food and energy prices.

‘Agriculture economic backbone’

The African Development Bank says the backbone of South Sudan’s economy, which depends 95 percent on oil revenues – is agriculture.

The oil production and export has since dwindled after being hit by multiple crisis including the impact of the civil war, the COVID-19 pandemic, and now the Sudanese conflict.

The AFDB said the value addition for South Sudan’s non-oil revenue GDP in agriculture, forestry and fishery used to account for 36% in 2010. This made the country a net exporter of agricultural product to regional markets.

But due to war-related destruction, poor infrastructure and lack of investment in the agriculture sector, AFDB says South Sudan is now a net importer of food.

It is estimated that South Sudan’s food imports is in the range of $200-300 million a year.

Multiple factors hindering the development of South Sudan’s agricultural sector are said to be lack of accessibility to markets by farmers due to the poor road network, insecurities and heavy taxation of farm products at checkpoints.

Others are lack of a critical farmers and rural producers associations as a means of entering the market place with the aim of minimizing the cost of inputs.

The continental bank recommends the need for improved agricultural inputs and techniques including the use of fertilizers, irrigation developments and storage facilities.

On May 11, 2023, South Sudan Minister of Agriculture and Food Security said the government is working to prioritize agriculture and other productive sectors to revive the economy.

Josephine Lagu said the country must tape into its other natural resources and end dependence on oil revenue.

She lamented that South Sudan has the capacity to produce enough food and export surplus to the region and beyond.

“We have the capacity to produce food in access to sell to the neighboring countries and beyond. We have not gotten there yet but we are working very hard in the government to ensure we improve our agriculture production,” she said.

She added that “we can diversify our economy starting from agriculture”, but it is not clear what practical measures have been put in place to realize the goal.

Support Eye Radio, the first independent radio broadcaster of news, information & entertainment in South Sudan.

Make a monthly or a one off contribution.

Copyright 2024. All rights reserved. Eye Radio is a product of Eye Media Limited.